SCCAOR’s Ballot Measure Voter Guide

SCCAOR Officially Opposes Measure E

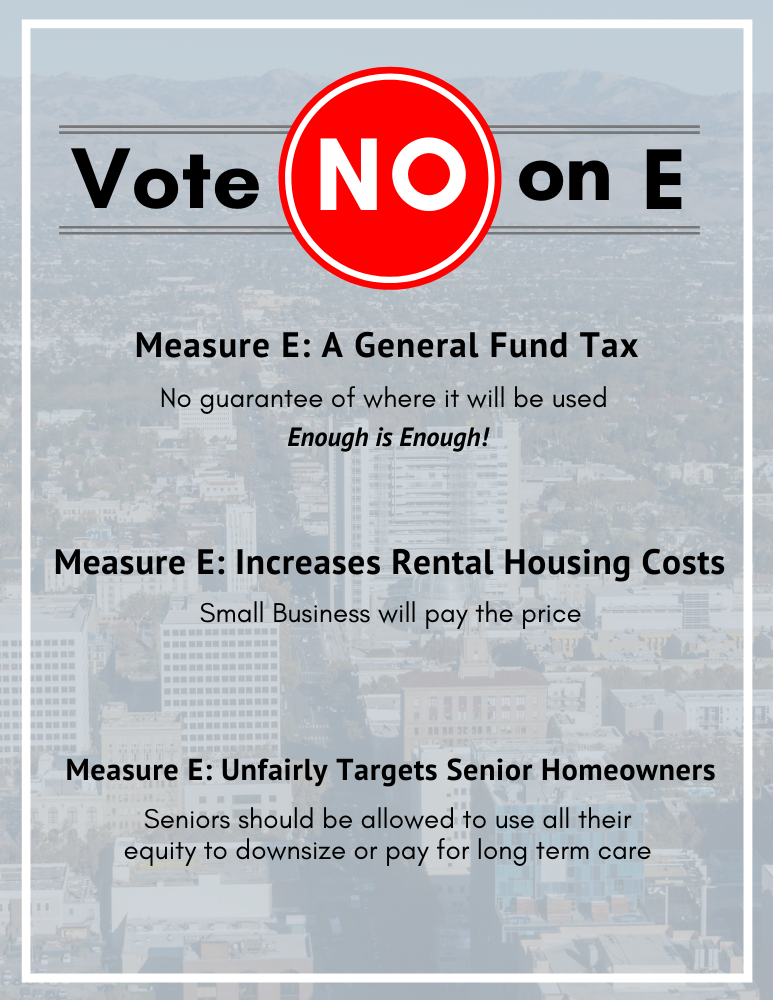

This position has been taken due to a lack of government accountability, an increasingly unfair burden on property owners to solve the housing crisis, and a possible decrease in housing supply from families feeling trapped in home as a result of higher point of sale costs.

This ballot measure looks to increase the real property transfer tax in the City of San Jose from $3.30 per $1,000 of assessed value (additional $1.10 is included from the County for a total of $4.40) to the new rates:

- Properties of $0 – $1,999,999.99 EXEMPT

- Properties $2,000,000 – $5,000,000 at 0.75%

- Properties $5,000,000.01 at 1.0%

- Properties $10,000,000 at 1.5%

Download and share these “No on E” assets

Social Media Graphic #1

Social Media Graphic #2

Social Media Graphic #3

The official ballot language is as follows:

“To fund general City of San Jose services, including affordable housing for seniors, veterans, disabled, and low-income families, and helping homeless residents move into shelters/permanent housing, shall an ordinance be adopted enacting a real property transfer tax including unrecorded transfers at these rates EXEMPT transfers under-$2,000,000 adjusted for inflation, $2,000,000 to $5,000,000 at 0.75%, $5,000,000.01 to $10,000,000 at 1.0%, and over $10,000,000 at 1.5%; generating approximately $70,000,000 annually, until repealed, with all money staying local?”

Flyer PDF

Johnny Khamis speaks out against Measure E

Other Local Measures

The Santa Clara County Association of REALTORS® opposes all parcel tax increases and bond measures. This is due to the barrier it creates for entry to homeownership and the burden placed on property owners. Supporting policies that promote not inhibit Homeownership is fundamental to the mission and purpose of SCCAOR.

Click on each Measure to learn more information

No on Measure G (School Bonds for Foothill-De Anza Community College District)

Foothill-De Anza Community College District

School Bonds

55% Vote

FOOTHILL-DE ANZA COMMUNITY COLLEGE DISTRICT AFFORDABLE CAREER, COLLEGE TRANSFER, CLASSROOM REPAIR MEASURE. To upgrade facilities preparing students/veterans for university transfer/careers like healthcare, nursing, technology, engineering/sciences; upgrade/repair aging classrooms, labs for science, technology, engineering/math-related fields of instruction; acquire, construct, repair facilities, equipment/sites; shall Foothill-De Anza Community College District’s measure authorizing $898,000,000 in bonds at legal rates, levying 1.6 cents/$100 assessed valuation ($48,000,000 annually) while bonds are outstanding, with audits/no money for administrators’ salaries, be adopted?

No on Measure H (Parcel Tax for Foothill-De Anza Community College District)

Foothill-De Anza Community College District

Parcel Tax

2/3 Vote

FOOTHILL-DE ANZA COMMUNITY COLLEGE DISTRICT EDUCATIONAL AND TEACHER EXCELLENCE MEASURE. To provide funding for local colleges that cannot be taken by the State; keep college education affordable; attract and retain quality teachers; support homeless, hungry students; maintain science, technology, health-science programs; and prepare students for university transfer, career and job training, shall Foothill-De Anza Community College District’s measure levying $48 per parcel for 5 years ($5,500,000 annually), be adopted, with citizens’ oversight, and with no funds for administrator salaries?

No on Measure I (School Bonds for Morgan Hill Unified School District)

Morgan Hill Unified School District

School Bonds

55% Vote

MORGAN HILL UNIFIED SCHOOL DISTRICT CLASSROOM UPGRADE/SAFETY MEASURE. To upgrade classrooms which retain/attract quality teachers; enhance student access to computer/modern technology; provide quality education; improve school safety, heating/cooling systems, restrooms, energy efficiency/handicapped accessibility; repair, construct, acquire classrooms, equipment, sites/facilities; shall Morgan Hill Unified School District’s measure authorizing $900,000,000 in bonds at legal rates, levying, on average, 4.7 cents/ $100 assessed value ($27,900,000 annually) while bonds are outstanding, be adopted, with annual audits, all funds spent locally?

No on Measure J (School Bonds for East Side Union High School District)

East Side Union High School District

School Bonds

55% Vote

To allow local high school teachers and staff members to live in the community in which they work and improve the school district’s ability to attract and retain highly qualified employees by constructing teacher-staff rental housing, shall East Side Union High School District measure authorizing $60 million of bonds be adopted with legal rates raising approximately $4.1 million for annual repayment while bonds are outstanding, projected levies of less than $0.003 per $100 assessed valuation, annual audits, citizens’ oversight?

No on Measure K (Parcel Tax for Campbell Union High School District)

Campbell Union High School District

Parcel Tax

2/3 Vote

To attract and retain high-quality teachers; increase teacher salaries; improve preparation for careers in technical fields including engineering, computer science, and health care; provide student mental health and suicide prevention services; and provide local high school students academic opportunities comparable to neighboring school districts, shall the Campbell Union High School District assess an annual parcel tax of $298 for 8 years, exempting senior citizens, providing approximately $16,600,000 annually, subject to independent oversight, annual audits, and local control?

No on Measure M (School Bonds for Moreland School District)

Moreland School District

School Bonds

55% Vote

MORELAND SCHOOL DISTRICT SAFETY MEASURE. To repair and update local elementary and middle schools, including student learning environments for 21st-century learning; make essential school safety improvements; repair leaky roofs; maintain technology; repair, acquire, construct classrooms, equipment, sites/facilities; shall Moreland School District’s measure authorizing $80,000,000 in bonds at legal rates, levying approximately $30/$100,000 assessed value ($5,700,000 annually) while bonds are outstanding, be approved, with citizen oversight, audits, no funds for administrators, all funds for local schools?

No on Measure P (Parcel Tax for Campbell Union School District)

Campbell Union School District

Parcel Tax

2/3 Vote

To help local elementary and middle schools attract/ retain high performing teachers, sustain strong academic and advanced programs in reading, writing, math, arts and sciences, ensure every student reads at/above grade level, keep teacher salaries competitive and train/support new teachers, shall a Campbell Union Elementary School District measure levying $98/ parcel annually, exempting senior citizens, be adopted, raising $2.36 million for 9 years, with independent community oversight, no funds for administrators, and all funds benefiting local schools?

No on Measure Q (Parcel Tax for Union School District)

Union School District

Parcel Tax

2/3 Vote

To protect academic excellence and maintain strong programs in reading, writing, science, technology, engineering, arts, and math for local elementary/middle school students; attract/retain high-quality teachers, and increase teacher resources, shall Union Elementary School District’s measure to levy $149 per year for 6 years, raising $1.9 million annually that cannot be taken by the State, be adopted, with independent community oversight, no funds for administrators, exempting seniors, all funds locally-controlled benefiting local schools?

No on Measure R (School Bonds for Franklin-McKinley School District)

Franklin-McKinley School District

School Bonds

55% Vote

To improve the quality of education at local schools, shall Franklin-McKinley School District acquire / construct / modernize / repair classrooms, infrastructure, facilities, and fields improving all student access, including those with disabilities, to modern facilities, technology, teaching, and safety improvements, by issuing $80,000,000 of bonds at legal interest rates, raising approximately $5.2 million annually through 2050 at rates of approximately 3 cents per $100 assessed value, with annual audits, citizens’ oversight, and No money taken by the State?

No on Measure S (Parcel Tax for Oak Grove School District)

Oak Grove School District Parcel Tax

2/3 Vote

To improve education, student achievement, and safety in neighborhood schools by:

• Hiring, retaining, and training high-quality teachers;

• Maintaining class sizes;

• Expanding math, science and technology education;

• Ensuring adequate student supervision and safety through appropriate staffing; and

• Providing physical education programs.

Shall the Oak Grove Elementary School District levy a parcel tax of $132 per parcel for nine years, providing $3.4 million ongoing annually, exempting seniors, with annual audits, citizens’ oversight, and all funds used locally?

No on Measure U (School Bonds for Berryessa Union School District)

Berryessa Union School District

School Bonds

55% Vote

BERRYESSA UNION SCHOOL DISTRICT CLASSROOM UPGRADE/SAFETY MEASURE. To repair/update local elementary/middle schools, including science, arts and math classrooms/labs for 21st-century learning; make essential safety and security improvements; replace aging fire alarms; repair, construct, acquire classrooms, equipment, sites/facilities; shall Berryessa Union School District’s measure authorizing $98,000,000 in bonds at legal rates, levying $28.50/ $100,000 assessed value ($6,300,000 annually) while bonds are outstanding, be approved, with citizen oversight, audits, no funds for administrators, all funds spent locally?

No on Measure V (School Bonds for Evergreen School District)

Evergreen School District

School Bonds

55% Vote

To acquire computers and classroom technology for improved student access; install campus security/emergency notification and communication alarms and systems; and renovate and modernize aging classrooms and facilities throughout the District; shall Evergreen Elementary School District’s measure authorizing $125,000,000 in bonds, with legal interest rates, projected yearly tax rates averaging less than $0.03 per $100 of assessed valuation raising an average $7.3 million per year for 18 years, annual audits and citizens’ oversight, be adopted?